“So, it becomes apparent, for the sake of humanity, that we must seriously re-consider nuclear power”, Oliver Stone, Nuclear Now 2022.

Introduction

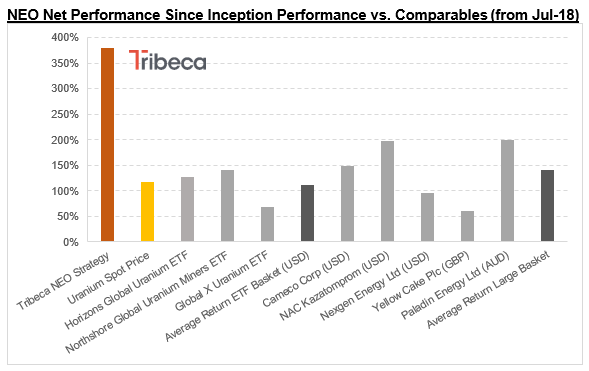

In a time when the world urgently seeks to transition to a net-zero emissions future, nuclear energy emerges as a significant contender in the race for clean and reliable power. With the increasing global demand for sustainable energy solutions, investing in the Tribeca Nuclear Energy Opportunities Strategy, expertly managed by Guy Keller, presents a compelling opportunity. This thought leadership piece explores the case for nuclear energy, focusing on uranium and its role in the net-zero transition. Through the lens of recent newsletters, we highlight the reasons why investing in this strategy aligns with the goal of achieving a sustainable future.

The Power of Nuclear Energy

Nuclear energy possesses the potential to transform electricity production while significantly reducing carbon emissions. Unlike traditional fossil fuel-based power generation, nuclear energy does not release greenhouse gases during operation, making it an environmentally friendly source of electricity. Its consistent and reliable power supply contributes to grid stability and reduces dependence on intermittent renewable energy sources. Globally, around 10% of the world’s electricity comes from nuclear energy, from 440 power reactors, with some countries relying on it heavily, especially France (~70% of electricity) and Sweden (~40%).

The Significance of Uranium

At the core of nuclear energy lies uranium, a naturally occurring element that serves as fuel for nuclear reactors. While market valuations of small and micro-cap uranium stocks may have experienced a decline, the fundamentals of the uranium market and nuclear fuel cycle activity remain strong. The Tribeca Nuclear Energy Opportunities Strategy presents an opportunity to capitalize on the growth potential of the uranium market.

Key Statistics

I. Uranium Demand and Shortage

II. Environmental Benefits

The Transition to Net Zero

The urgency to combat climate change has driven the global push towards achieving net-zero emissions. Nuclear energy offers a reliable and efficient power source that can play a crucial role in this transition. As countries seek to reduce their carbon footprints, nuclear power presents a low-carbon alternative to traditional energy generation. By investing in the Tribeca Nuclear Energy Opportunities Strategy, individuals can position themselves to benefit from the increasing demand for clean and sustainable energy solutions.

Advantages of Investing in the Tribeca Nuclear Energy Opportunities Strategy

I. Diversification and Stability

II. Growth Potential

Recent Developments and Endorsements

Various broker notes and press reports underscore the positive sentiment surrounding nuclear energy. The Bank of America Global Research Report titled “The Nuclear Necessity” released in May, emphasizes the emergence of the third bull market in uranium. The report highlights the underinvestment in uranium over the past decade, leading to a visible shortage and rising global demand. It also notes the potential upside risk of G7 sanctions on Russian production, a factor not yet priced into uranium equities.

Furthermore, endorsements from influential figures and organizations further support the investment thesis:

Investing in the Tribeca Nuclear Energy Opportunities Strategy offers a compelling opportunity to participate in the potential of nuclear energy during the net-zero transition. With a focus on uranium and the increasing demand for clean and sustainable power, this strategy aligns perfectly with the global movement towards a sustainable future. Nuclear energy’s stability, reliability, and minimal environmental impact make it an attractive investment choice. Moreover, under the expert management of Guy Keller, investors can capitalize on emerging opportunities within the nuclear energy sector. By investing in this strategy, individuals can contribute to the acceleration of a sustainable, low-carbon future while positioning themselves for long-term success.

By clicking 'Agree' at the bottom of this page you are confirming that you are a wholesale client for the purposes of section 761G of the Corporations Act 2001 (Cth). You further acknowledge that the information on this website is of a general nature only and does not have regard to the particular circumstances, investment objectives or needs of any specific recipient. It is not intended to constitute investment advice nor a personal securities recommendation.