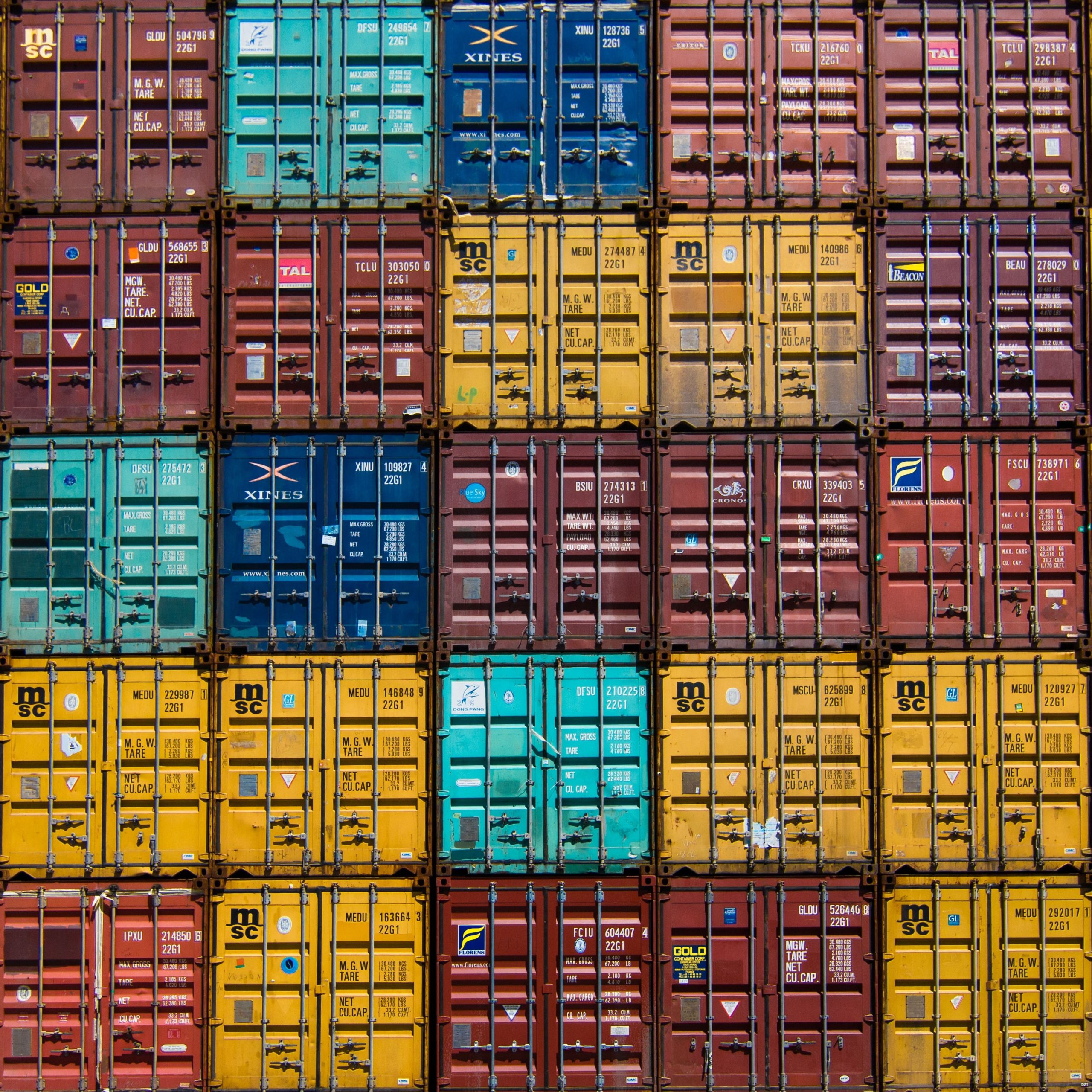

In this inaugural edition of Tribeca Asia Infrastructure Commentary, we delve into the world of logistics, which is over 10% of global GDP. We focus on the structural changes, challenges, opportunities and investment outlook for the sector. High quality companies in the logistics sector offer attractive growth profiles with the ability to develop moats around their businesses through operations and technology. The Tribeca Asia Infrastructure Fund ‘TAIF’ has ~18% of its exposure to market-leading logistics service providers across the Asia Pacific market.

TAIF remains constructive on the logistics sector given its attractive growth profile as well as the ability of companies to build moats around their operations and technology. During the pandemic, the sector managed volatility well, while acting as a backbone to the global economy which was severely affected by travel restriction. Post-pandemic, the sector’s profitability stayed higher than pre-pandemic levels. In addition, the market leaders gained market share, improved balance sheets and increased moats. While in near term, freight rates may soften further, the increasing complexity of the supply chain and the structural changes in global trade, we believe the market leaders’ profitability will remain much more resilient and less volatile compared to the pre-pandemic period.

TAIF has c18% exposure to logistics service providers as at the end of October 2022. This includes 3PL, freight forwarding, express/full/partial truckload and warehousing services in the Asia Pacific market. Companies in our portfolio are leaders in each of their respective areas. Despite long term robust growth outlook, the sector is relative niche and there is no exclusive ETF to get exposure to the sector.

Read the full article by clicking here.

Susanta Mazumdar is the Portfolio Manager for the Tribeca Asia Infrastructure Strategy, which aims to earn superior, risk adjusted total returns through a mix of long-term capital appreciation and cash yield by investing in infrastructure companies across the Asia-Pacific universe using an index-unconstrained concentrated portfolio approach.

By clicking 'Agree' at the bottom of this page you are confirming that you are a wholesale client for the purposes of section 761G of the Corporations Act 2001 (Cth). You further acknowledge that the information on this website is of a general nature only and does not have regard to the particular circumstances, investment objectives or needs of any specific recipient. It is not intended to constitute investment advice nor a personal securities recommendation.